salt tax cap removal

The relaxed cap an increase from the current 10000 limit would last for a decade until 2031. The SALT deal appeared to remove one obstacle to passing the sprawling.

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan

Murphy pushing for SALT cap removal isnt willing to make an ultimatum.

. Sales of tangible personal property to Petitioner as a. While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to reduce the tax break. The latest SALT plan would remove the current 10000 cap part of the 2017 tax overhaul entirely for those making less than 400000 a year.

This cap remains unchanged for your 2021 taxes and it will remain the same in. From tax under Section 1116a of the Tax Law receipts from the sale of such service to the exempt organization are not taxable. Larger Tank Sizes are available please call for details.

The SALT deduction benefits only a shrinking minority of taxpayers. As President Bidens tax plans are considered in Congress the future of the 10000 cap for state and local tax deductions SALT is becoming an important part of the tax. The fight to remove the cap for state and local taxes SALT continues for three North Jersey members of the House.

Section 1105c3 iii of the Tax Law provides. Trumps tax law limited SALT deductions to 10000 meaning that residents in higher-tax states like New York and New Jersey could no longer deduct the full value of their. Property so that removal would cause material damage to the property or article itself.

845-255-4900 Long Island. 52 rows The deduction has a cap of 5000 if your filing status is married filing separately. By Joey Fox October 20 2021 252 pm.

A deal later announced between Manchin and Senate Majority Leader Chuck Schumer on a fiscal package that spans tax climate and health care measures also omitted. And C Is intended to become a permanent installation. In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep.

Josh Gottheimer Tom Malinowski and Mikie. Responding to reports from yesterday that the State and Local.

2 In 1 Stainless Steel Manual Salt Pepper Mill Grinder Seasoning Cooki Salt Pepper Mills Cooking Tools Stuffed Peppers

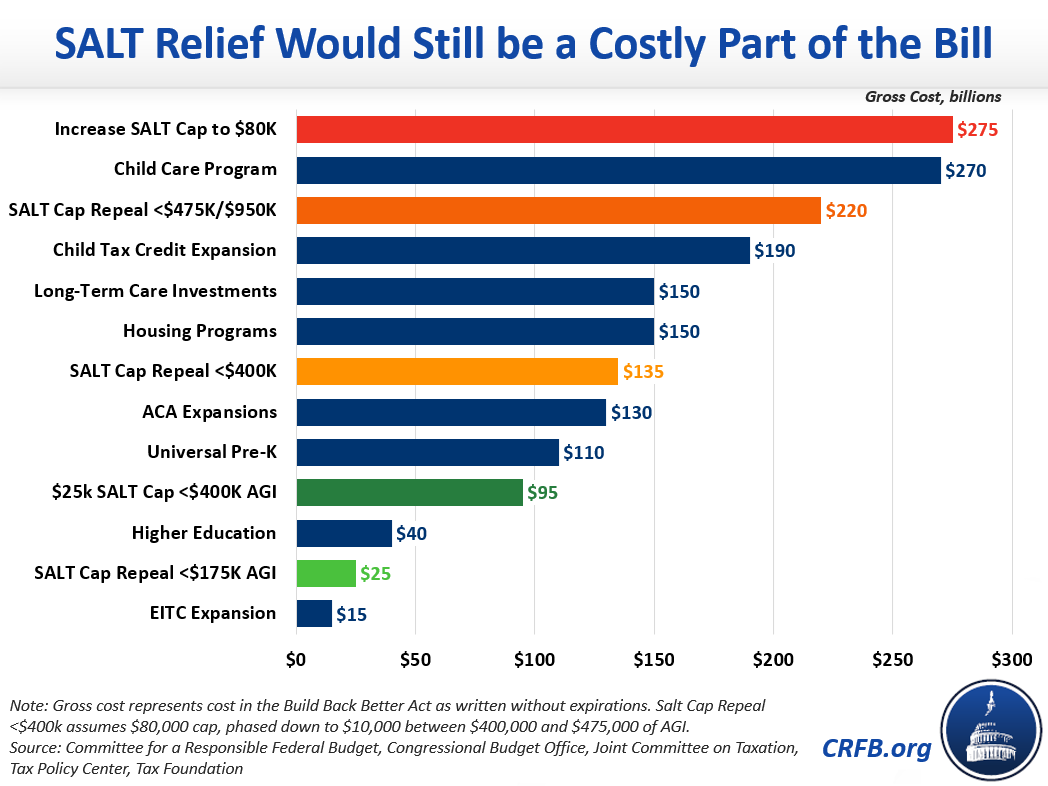

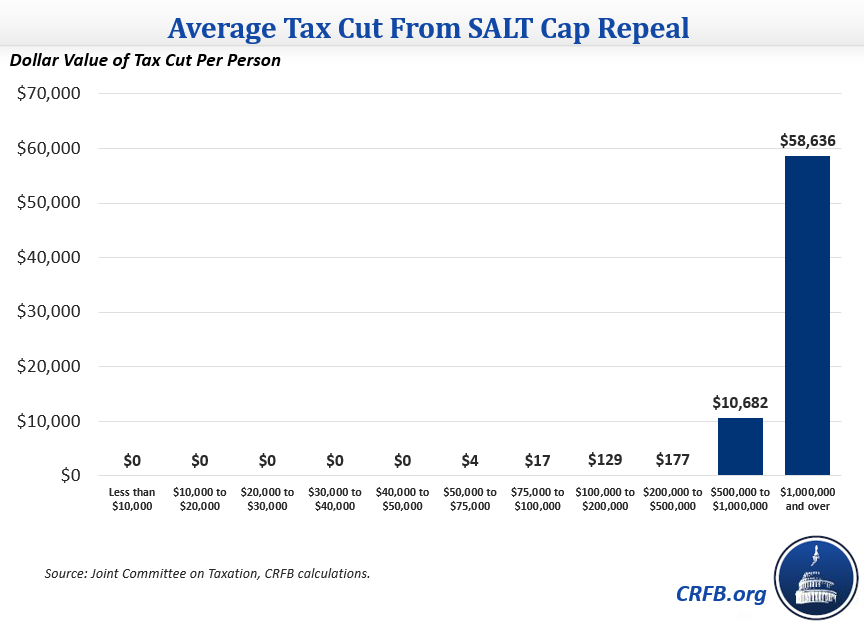

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Dems Don T Repeal The Salt Cap Do This Instead Itep

Salt Deduction Relief May Be In Peril As Build Back Better Stalls

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Salt Deduction Cap Was Part Of A Package Wsj

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Don T Miss The Election For The Salt Cap Workaround

/StateandLocalTaxCapWorkaround-1bbc2598e0144769b6e2542e11d22839.jpg)

State And Local Tax Cap Workaround Gets Green Light From Irs

_Table-1800px_v2a.jpg)

Can You Benefit From The Salt Cap Workaround J P Morgan Private Bank

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

House Democrats Concede Line In Sand Over Ending Salt Cap Politico